- SME Financing

- Micro Financing/-i

Boost your cash flow in 5 days. - Business Term Financing - Portfolio Guarantee (PG)

Partially secured by CGC - Business Term Financing/-i

Finance your business growth. - Invoice Financing/-i

Convert your invoices into cash. - Tailored for used car dealerships.

Tailored for used car dealerships. - Property-Backed Secured Financing

Leverage your property for funds

- Micro Financing/-i

- Invest

- About Us

- Refer

- FAQ

- Blog

-

Micro Financing/-iBoost your cash flow in 5 days.

-

Business Term Financing/-iFinance your business growth.

-

Invoice Financing/-iConvert your invoices into cash.

-

Dealer Financing - Used CarTailored for used car dealerships.

-

Dealer Financing - MotorcycleTailored for motorcycle dealerships.

Dealer Financing - MotorcycleTailored for motorcycle dealerships. -

Property-Backed Secured FinancingLeverage your property for funds

Invoice Financing/-i

Convert Your

Invoices

into Cash Upfront

-

Credit line up to RM 1 million

-

Tenure up to 120 days

-

Shariah financing available

- Cater for Buyers

- Financing up to 100% of invoice value

- Financing up to RM1,000,000

- Tenure up to 120 days

- Cater for Buyers

- Financing up to 80% of invoice value

- Financing up to RM1,000,000

- Tenure up to 120 days

Invoice Financing/-i is open to

- Sole proprietorships, partnerships, limited liability partnerships, private limited companies (non-subsidiary of a listed company), unlisted public companies, or public listed companies and subsidiaries.

- Minimum 30% local shareholding by Malaysians

- Minimum RM 1 million revenue per annum

- Minimum 1 year in operations

The financing solution

to ease your cashflow

Collateral Free

We focus on your business potential and we generally don’t ask for your assets (e.g. property or fixed deposits) as collateral.

Full Transparency

We will inform you of the costs and fees involved upfront, with no hidden fees for you to worry about. Fees are charged on a success basis.

Hassle-Free

We have a hassle-free online application process, so you can apply for financing from the comfort of your home.

Flexible Repayment Options

We offer tenures for financing from 30, 60, 90 to 120 days, for your convenience.

How To Apply?

Check Eligibility

Leave your contact information. Our team will contact you within 2 working days.

Then, prepare the following documents:

-

Copy of all Director(s) NRIC/Passport

-

Latest 6 months bank statements, and

-

Latest audited accounts & management accounts

Financing Application

Submit your documents for us to review, we may request additional documents to support your application.

Financing Offer & Disbursement

We aim to revert to you within five (5) working days upon collection of full and complete documents. Once approved and accepted, we will disburse the funds upon successful completion of the investment process.

We've got you covered

Not what you’re looking for?

We have other financing solutions available to serve your needs.

Further Readings

How Does Invoice Financing Work: The Complete Guide

Invoice financing allows small businesses to finance slow-paying invoices. We provide a comprehensive guide to the invoice financing process and reveal its advantages. Read more!

Invoice Financing FAQs

Invoice financing is a business tool used by most Malaysian SMEs today. Learn more about how your business can use Invoice Financing to maintain cashflow.

The Ultimate Guide to Invoice Financing in Malaysia

Invoice Financing is a facility all SMEs need. Check out this ultimate guide to invoice financing and grow your SMEs with better cash flow!

Frequently asked questions

-

What is Invoice Financing/-i?

Invoice Financing/-i is a broad concept of financing arrangement where it allows companies to finance their early payment on their sales invoices or sales purchases, for goods delivered and/or services completed. This method of financing is ideal for businesses in need of consistent cash flow or cash upfront, especially if the majority of their transactions are on credit terms.

-

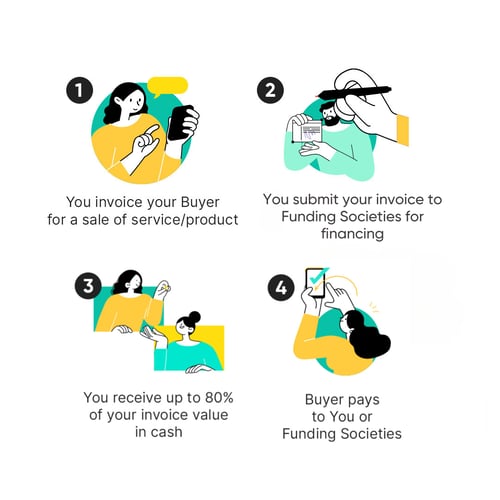

How does Invoice Financing/-i work?

With Funding Societies, you have two options of Invoice Financing that would suit your needs; Accounts Payable (AP) Financing (Conventional & Islamic) and Accounts Receivable (AR) Financing (Conventional & Islamic).

Additionally, you will have access to our online supply chain financing system, Silk Road, to manage your financing facility with us.AR Financing/-i is typically meant for financing sales invoices, with your perspective as the Seller.

AP Financing/-i is typically meant for financing sales purchases, with your perspective as the Buyer.

Process Flow

Account Payable Financing/-i (APF/-i)

Step 1: Customer submits PO/Proforma invoice etc. via Silk Road

Step 2: Funding Societies proceed credit assessment and approval email provides once approve.

Step 3: Customer receives disbursement from Funding Societies based on the approved terms

Step 4: Repayment to Funding Societies based on the approved termsAccount Receivable Financing/-i (ARF/-i)

Step 1: Customer submits Invoice & DO etc. via Silk Road

Step 2: Funding Societies proceed credit assessment and approval email provides once approve.

Step 3: Customer receives disbursement from Funding Societies based on the approved terms

Step 4: Repayment to Funding Societies based on the approved termsNotified :

Buyers are notified of the arrangement between Seller and Funding Societies.

Thus, Buyer pays Funding Societies as per approved terms.Non-notified (applicable to AR Financing only) :

Buyers are not notified of the arrangement between Seller and Funding Societies.

Thus, Buyer pays Seller as per invoice terms, then, Seller pays Funding Societies as per approved terms. -

How long is the tenure?

With Funding Societies Invoice Financing, you can apply for a financing tenure of up to 120 days.

Depending on the nature of your business and its trade cycle, you have the option to apply for a tenure of 30, 60, 90, or 120 days.

-

How do I apply?

If this is your first time with us, here is a run-through on the application process.

1. Complete the application form.

2. Prepare the following documents to support your application:

-

Company Registration Forms

-

Copy of all Director(s) NRIC/Passport

-

Latest 6-months Bank Statement

-

Latest Audited Accounts & Management Accounts (if available)

We will reach out to you shortly after your application.

Should there be a need for additional documents/information, we will request those accordingly. -

-

Are there any fees and charges?

Just like any other financing product, the following fees/charges will be applicable:

Accounts Payable Financing/-i

- Application / Registration Fee

For Conventional & Islamic: RM50 per supplier or debtor. - Facility Fee/ Up-Limit Fee

For Conventional & Islamic: Up to 1% of the approved/increased limit of the financing facility (applicable for revolving only). - Utilisation Fee/ Drawdown Fee

For Conventional & Islamic: Up to 2% per drawdown (to be deducted from total disbursement amount)

Accounts Receivable Financing/-i

- Application / Registration Fee

For Conventional & Islamic:RM50 per debtor. - Facility Fee/ Up-Limit Fee

For Conventional & Islamic: Up to 1% of the approved/increased limit of the financing facility (applicable for revolving only). - Utilisation Fee/ Drawdown Fee

For Conventional & Islamic: Up to 2% per drawdown (to be deducted from total disbursement amount.)

Please take note that the above are the common fees/charges of Invoice Financing/-i which serves as a guide, varying from product to product and subject to change from time to time.

For more accurate and updated fees/charges, kindly check with us.

- Application / Registration Fee

-

What if I can’t make my payments on time?

If you are late in making your repayments, the following fees/charges will be imposed:

-

Late Penalty Fee: RM 250 per 7 calendar day

-

Late Interest Fee: Up to 0.1% per day (non-compounded) on the amount in arrears

-

-

Can I make an early settlement?

Of course! If you choose to settle the financing early, there are NO fees or charges imposed!

-

What are the Shariah principles adopted for Shariah-compliant Invoice Financing-i?

The Shariah principle used is Commodity Murabahah via Tawarruq arrangement. Tawarruq refers to purchasing of Shariah compliant Commodity with deferred price, then selling it to a third party to obtain cash.

-

Who can apply for Invoice Financing-i?

Any businesses whose principal activities are Shariah compliant (e.g. not related to tobacco, liquor, gambling etc.) can apply for the financing.

Funding Societies will be conducting Shariah screening to ensure proceeds to be raised are utilised for general working capital requirements and business purposes of the issuer which are Shariah compliant.

Malaysia

[email protected]

Primary contact

+603 9212 0208

Secondary contact

+603 2202 1013

Unit 15.01 & Unit 15.02,

Level 15, Mercu 3,

KL Eco City, Jalan Bangsar,

59200 Kuala Lumpur

Indonesia

Pemberi Dana

[email protected]

+62 877 7126 5290

Penerima Dana

[email protected]

+62 877 7873 6144

Unifam Tower, Jl. Panjang Raya

Blok A3 No.1, Kedoya Utara,

Kebon Jeruk, Jakarta Barat,

DKI Jakarta, 11520, Indonesia

Singapore

[email protected]

General Enquiries:

+65 6221 0958

Sales Enquiries:

+65 6011 7534

108 Robinson Road

#06-01

Singapore 068900

Thailand

SME Loan

[email protected]

+66 93 139 9721

Investment

[email protected]

+66 62 197 8661

No. 29, Vanissa Building,

24th Floor, Room No. 2412 & 2414, Soi Chidlom,

Ploenchit Road,

Lumpini, Pathumwan,

Bangkok, 10330

Vietnam

[email protected]

(+84) 28 7109 7896

The Sentry P

16 Nguyen Dang Giai Street,

Thao Dien Ward, Thu Duc City,

Ho Chi Minh City, Vietnam

Dreamplex

174 Thai Ha Street,

Trung Liet Ward, Dong Da District,

Hanoi, Vietnam

Services

Who We Are

Media

-

Singapore

-

Indonesia

-

Malaysia

-

Thailand

-

Vietnam

Registered with Securities Commission Malaysia.

Modalku Ventures Sdn Bhd 201601019329 (1190266X)

© 2025 Modalku Ventures Sdn Bhd. All rights reserved.

Funding Societies is a SME Digital Financing Platform registered with Securities Commission Malaysia. It does not fall under the jurisdiction of Bank Negara Malaysia. Therefore, financing products of Funding Societies should not be constructed as business loan, SME loan, micro loan, term loan or any other loans offered by banks in Malaysia and it is to be deemed as an investment note as defined in the Guidelines on Recognised Markets.

Disclaimer: All third party trademarks, product and company names are the property of their respective holders.