Our Approach to Sustainability

We believe financing can be a powerful force for good. By providing capital and guiding SMEs toward sustainable business practices, we're not just funding businesses, we're building stronger societies.

By aligning our actions with environmental, social, and governance principles, we balance financial performance with meaningful environmental and social impact—creating long-term value that benefits businesses, communities, and the planet alike – in line with the triple bottom line principles.

Our Sustainability Pillars

Stronger Societies

Empowering Southeast Asia’s SMEs through increasing access to financing.

Stronger Planet

Supporting the transition to a greener economy in Southeast Asia.

Stronger People

Focus on creating an inclusive, diverse and equal space for our stakeholders to do business responsibly.

How Funding Societies Implements Sustainability and Empowers SMEs

.png?width=150&height=150&name=2%20(1).png)

Integrate ESG Risks

into Credit Assessment

.png?width=150&height=150&name=1%20(1).png)

Champion ESG

and Sustainability

Education Internally

.png?width=150&height=150&name=3%20(1).png)

Finance SMEs

in Circular Economy

and Green Industries

.png?width=150&height=150&name=4%20(1).png)

Collaborate with

partners to contribute

and advocate for

sustainability-conscious

SME community

The UN SDGs are goals set out by the United Nations to help the world achieve a sustainable future for all without leaving anyone behind. These 17 goals serve as a blueprint for the world to achieve peace and prosperity for people and the planet, both now and in the future. Through our mission to create stronger societies, we are able to contribute to the SDGs through our sustainability initiatives on five of the goals:

Funding Societies | Modalku is a signatory to the UN Global Compact to operate responsibly, in alignment with universal sustainability principles. We adhere to UNGC’s 10 principles covering the areas of labour, human rights, environment and anti-corruption, joining other global companies as frontrunners in sustainability.

ESBN Green Deal

Want to kickstart your sustainability and ESG data reporting journey?

Take this free ESG self-assessment tool for SMEs powered by our partners, STACS - ESGpedia.

Take the assessment now and attain your Green, Silver, or Gold ESBN Asia-Pacific Green Deal Badge for greater recognition and visibility of your business sustainability. This assessment will help you to:

-

Meet investors' and regulatory demands.

-

Access new financing opportunities.

-

Improve your competitiveness.

Our Participation in Sustainability Space

Our Co-Founder & Group CEO, Kelvin Teo, shared key insights at the Impact Investing Roundtable 2025 during Temasek's Ecosperity Week.

Modalku participated in the Liberty Society and ISSP's Sustainability Roundtables & Networking Event in Jakarta, discussing the role of sustainability professionals in driving sustainability in their organization.

Our team participated as panelists in the Sembrani Impact Accelerator by BRI Ventures, discussing financial sustainability and the importance of sound business models for long-term growth.

Our leaders, Kelvin Teo, Co-Founder & Group CEO, and Annette Aprilana, ESG & Sustainability Lead, spoke at the 2023 Tech in Asia Conference in Jakarta, sharing insights on sustainability in the Fintech Space.

Past Events

The B20 Indonesia Summit 2022

We were a member in the Finance and Infrastructure Task Force and the Women in Business Action Council

Green Economy Indonesia Summit (GEIS) 2022

Annette Aprilana, our Sustainability and ESG Lead spoke at the Green Economy Indonesia Summit (GEIS) 2022

Sustainability Academy

Seller Acceleration Camp Modalku x Lazada Lazada Sustainability Academy: Seller Accelerator Camp - Signing of MoU where Modalku participates as a financing partner

ASEAN BAC Awards

Funding Societies | Modalku was selected as the winner for the category "Trade and Investment Facilities - Innovative Investment"

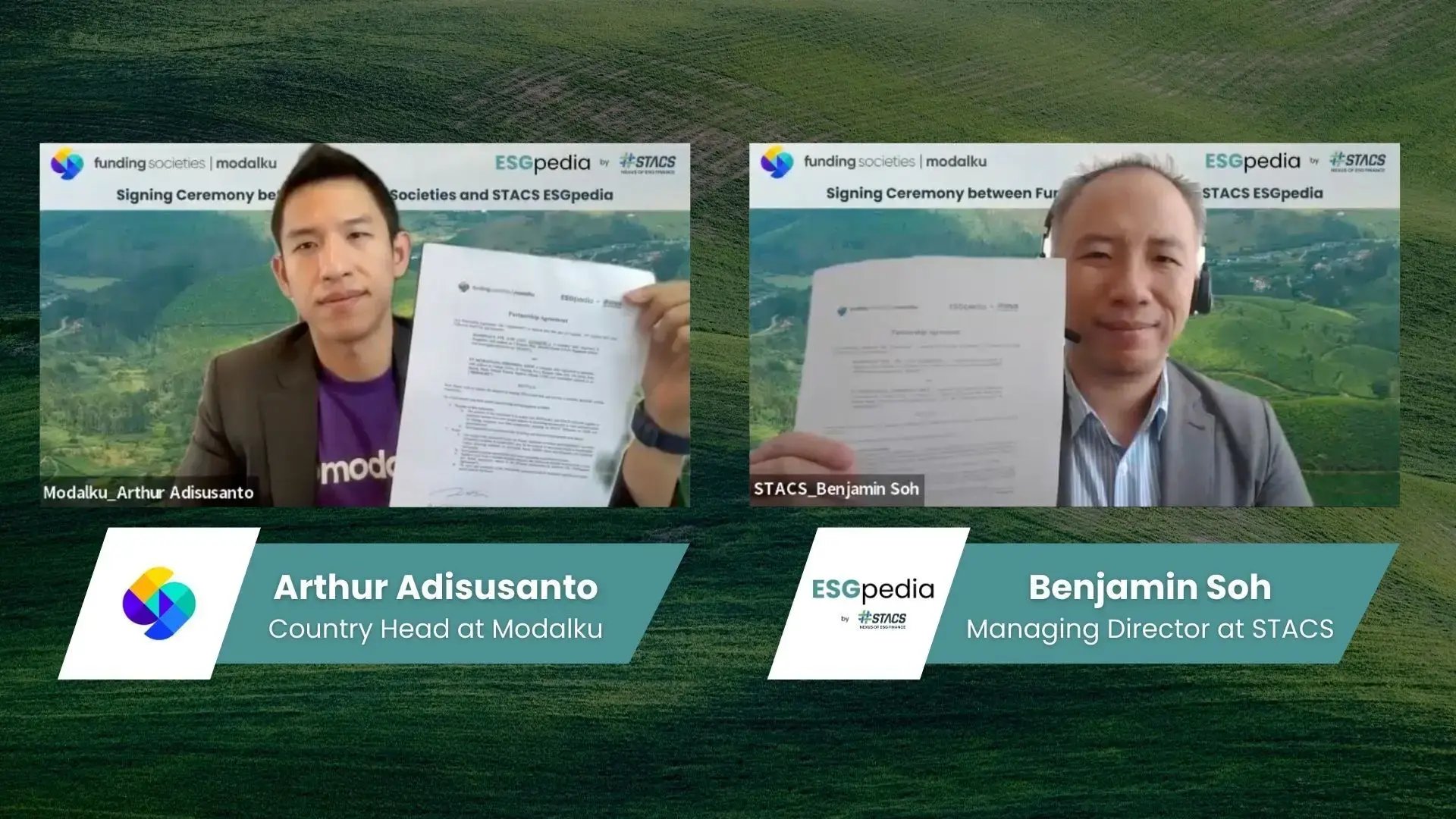

Collaboration with STACS

Modalku collaborates with STACS to utilize STACS ESGpedia platform to support ESG reporting and sustainable financing access for MSMEs in Indonesia.

Asia-Pacific Business Forum (APBF) 2022

Kelvin Teo, Co-founder & Group CEO Funding Societies | Modalku spoke at the Asia-Pacific Business Forum 2022

Funding Societies Economic Impact Report

CIIP Case Study on Modalku (2024)

Funding Societies is honored to be featured in a special case study report by the Centre for Impact Investing and Practices (CIIP), as part of the 2023 Financial Inclusion study titled “Financial Inclusion in Post-COVID Southeast Asia: Accelerating Impact Beyond Access.” The report highlights our unique approach to financial inclusion and showcases our efforts to address key challenges and create meaningful, lasting impact in the communities we serve.

Accelerating Impact Beyond Access (2023)

FSMK participated in a groundbreaking study on financial inclusion in Southeast Asia. The 'Accelerating Impact Beyond Access' report, released by the Centre for Impact Investing and Practices & Temasek Trust, highlights the immense potential of this region. Read the full report.

FSMK Economic Impact Report (2021)

Of the 73 million MSMEs in Southeast Asia, around 39 million (51%) are either unserved or underserved by financing services - which led to a financing gap of US$272 billion, despite their potential MSMEs to provide significant employment opportunities and contribute tremendously to national Gross Domestic Product (GDP). Find out more about our regional impact study.