-

What they spend on

-

How they send and receive payments

-

How they secure funding

-

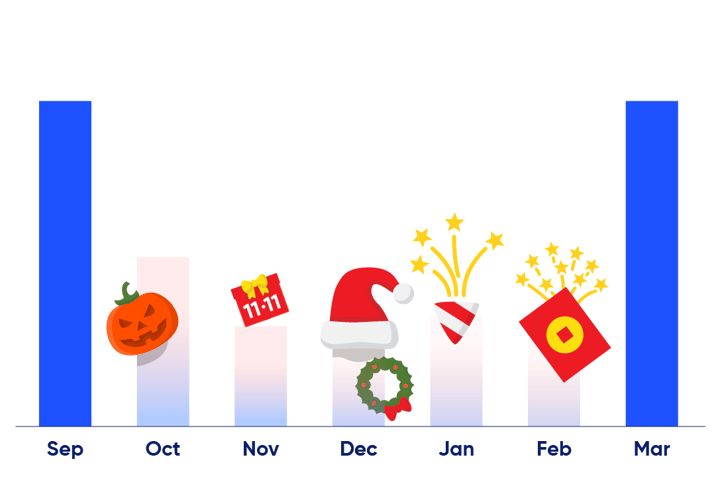

Their financing needs and insights into spending seasonality

-

Their overall business outlook

About The Study

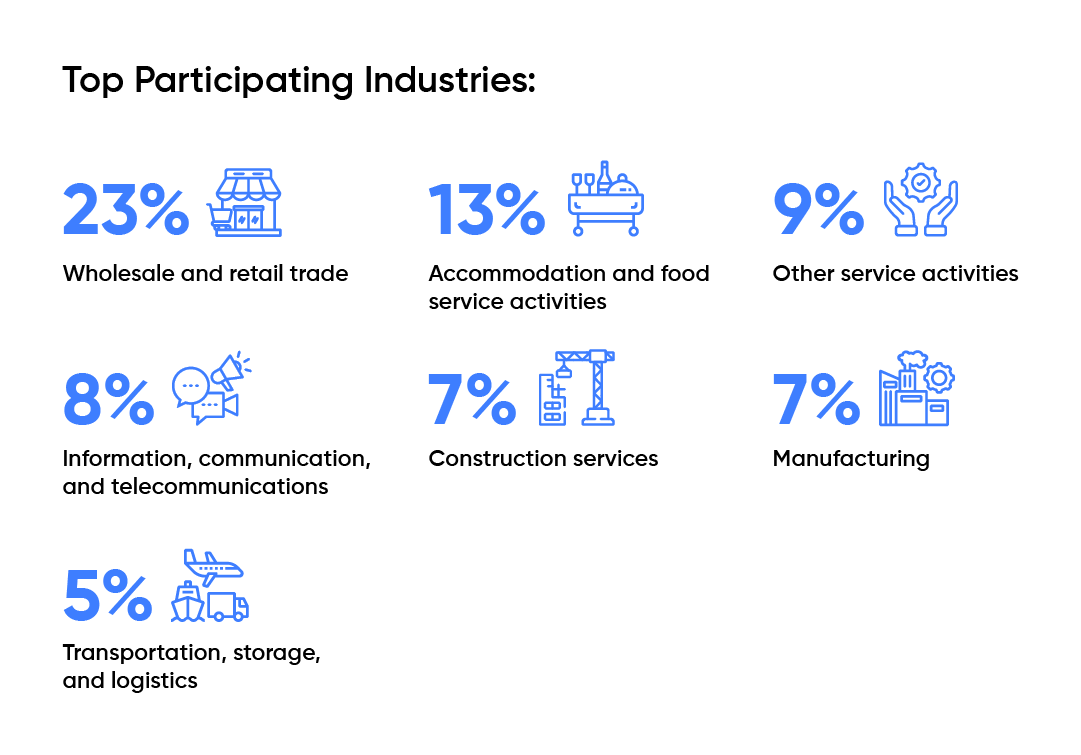

To find out, we surveyed 977 SMEs in Indonesia, Malaysia, Singapore, Vietnam, and Thailand from across several industries. Most respondents fall under the micro SME category (74%) and are the business owners themselves (63%).

Keen, Yet Cautious: SMEs Struggle With Financial Access in Southeast Asia

The Way Forward for Southeast Asia’s SMEs: New Solutions for Old Problems

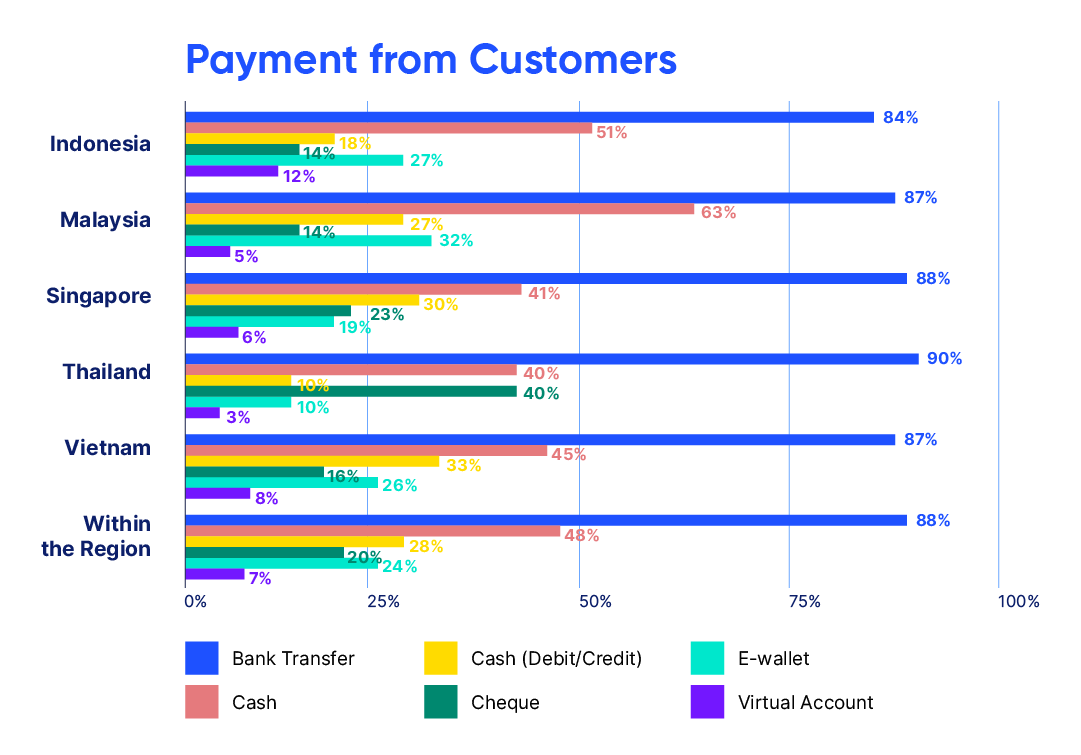

A vast majority still depend on banks to send and receive payments. Most SMEs’ transactions are also primarily local, with only a small portion doing cross-border transactions. And while many use accounting software to automate payment processes, there is a need for payment collection solutions — for both recurring, high-value transactions and mass payments — that would make the process easier and minimise late payments from customers.

Get the report

Recommended Reading

Invoices are strongly tied to small and medium-sized enterprises (SMEs) cash flow. It’s no secret that effective management of these invoices is mission-critical to the SMEs’ survival.

As the news suggests, economists are warning of an incoming global recession. The backbone of our economy, small and medium-sized enterprises or SMEs, are the most vulnerable to economic recession. Read more to find ways SMEs can prepare to survive a global recession.

Consumer spending on halal products is projected to hit USD 4.96 trillion (RM22.34 trillion) by 2030. To realise that goal of growing Malaysia's halal economy, the Halal Development Corp Bhd (HDC) aims to assist up to 50,000 small and medium enterprises (SMEs) to get certified by 2030, with Islamic Financing efforts.